SmartBiz

Online Payday Personal Consumer Loans up to $5,000

Easy Application, Fast Processing, Quick Approval, Any Credit Score

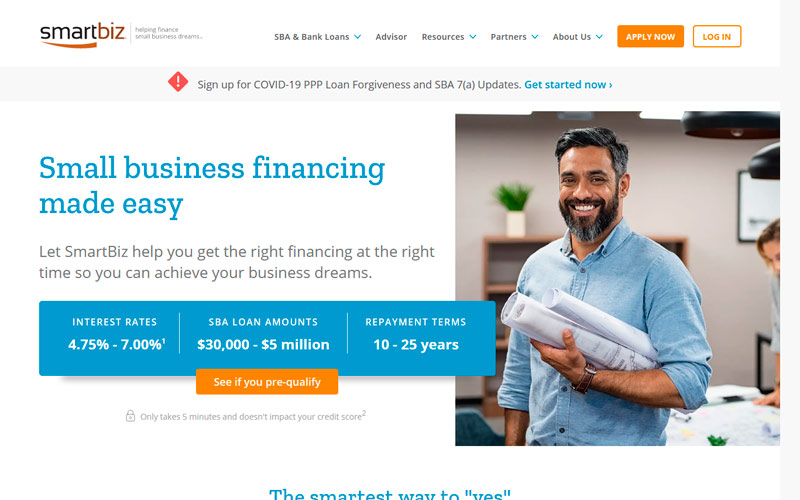

Request a LoanSmartBiz is a lender offering business loans. The selected banks in the business lending network have funded over $1.5 billion in small business loans. This company offers SBA and bank term loans under $350,000. Almost 90% of loans are approved by the banking institutions in their business network.

| Company name | SmartBiz |

| Founded | Unknown |

| Address | 433 California Street, San Francisco, CA 94104 |

| Website | https://www.smartbizloans.com/ |

| Phone number | (866)-283-8726 |

| [email protected] |

Pros

- Business Loans

- Loan Amount for up to $300,000

- Reasonable Interest Rate

- Clear Procedure

Cons

- 7 Days to Transfer Funds

- Increase APR

Bottom Line

SmartBiz is an online lender that offers SBA and bank term loans. The maximum loan amount is $350,000. SBA loans through banks in the SmartBiz lending network have a variable rate of Prime Rate plus 1.5% to 3.75%. It provides loans using an online application.

Types of Loans

SmartBiz offers SBA and bank term loans. SBA loans are a government-guaranteed small business loan that has a long-term and a low-interest rate. Bank term loan is a short-term, fixed-rate loan with stable monthly payments.

Requirements

SBA Loans from $30,000 to $350,000 requirements are:

- Minimum 2 years in business

- U.S. based business owned by a US citizen or Lawful Permanent Resident who is at least 21 years old

- Good personal credit score of 640 or higher

- No outstanding tax liens

- No bankruptcies or foreclosures in the past 3 years

- No recent charge-offs or settlements

- Current on government-related loans

SBA from $500,000 to $5 million requirements are:

- The real estate must be majority owner-occupied

- Time in Business: 2+ Years

- Business owners must have personal credit scores above 675

Bank term loans’ requirements are:

- 2+ years in business

- Business owners must be U.S. citizens or legal permanent residents

- Business owners must have personal credit scores above 640

- Cash flow to support loan payments

Category: Online Loans

Tags: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

Posted by Deborah Wagner