Get Emergency Cash Loans in Under 24 Hours – Apply Online Today!

Whether you need fast cash to cover emergency expenses like car repair, home improvements, to purchase a last-minute tour or cover a gap in income, personal loans can help meet that need.

Personal loans often come with lower interest rates, especially for people with good to excellent credit. Besides, many lenders offer same- or next-day funding so you can get the money you need quickly

Apply for the best personal loans for emergencies! They offer quick and straightforward applications and approvals, relaxed eligibility criteria, and instant funding!

Contents:

- What is an emergency cash loan?

- What can emergency cash loans be used for?

- 5 types of emergency loans

- Where can I get an emergency cash loan?

- Steps to get an emergency loan

- Emergency loan rates & terms

- Can I take out an emergency cash loan with bad credit?

- Will an emergency loan impact my credit score?

- Borrower requirements for emergency cash loans

- How fast can I get an emergency loan?

- How to choose an emergency loan

- Why use us to find emergency cash loans?

- Tips to get an emergency loan with bad credit

- Emergency loan alternatives

What is an emergency cash loan?

Emergency loans are personal loans that help pay for a wide range of emergencies or provide extra cash to deal with unexpected expenses. For example, you or your close person may have a sudden health issue. You may have to go on a business trip unexpectedly or purchase a new refrigerator. Your apartment may sustain storm damage that insurance doesn’t cover. Apply for a personal loan to help you cover unforeseen expenses. By taking out a personal loan, you can handle what needs special attention now and pay off the loan over time.

What can emergency cash loans be used for?

- A natural disaster event

- A major car repair

- Rent and mortgage payments

- A school fee for students

- Utilities

- Medical bills

- Funeral expenses

- A big appliance replacement

These are situations that sometimes can’t be foreseen. An emergency cash loan can help to provide some relief in such circumstances. It’s important to mention that you should never use this type of loan without having a reliable repayment plan.

5 types of emergency loans

If you need fast cash in an emergency, there are several popular options to consider. But what type of loan you are eligible for can largely depend on your credit.

Personal loans

If your credit is in good standing, you may be eligible for an unsecured personal loan. Such emergency cash advance loans can be used for emergency situations. These are typically installment loans given out in one lump sum with a predetermined interest rate. Personal loans could have lower interest rates than credit cards and can be repaid over an agreed period of time.

You don’t need to borrow a lot of money, either. If you need $1,000 or less, a small personal loan can help you out. Just remember that you should borrow only what you really need and can comfortably afford to repay on time.

Credit card cash advance

A cash advance is basically using the available balance on your credit card to take out a loan. The credit card company generally charges a higher interest rate for cash advances than it does for regular purchases, + a processing fee. In addition, interest will start accruing on the advance when you receive the money, so be wary of how much funds you request.

Payday loans

A payday loan is a short-term loan that typically must be paid off as soon as you receive your next paycheck. Unlike a traditional personal loan, which is usually repaid in installments, these emergency cash loans online are paid off all at once – in one lump sum. Yes, payday loans can be a good option to consider when seeking emergency cash. They can be ideal for those who just need access to short-term finance – lending terms typically range from 1 to 3 weeks.

So if you are sure you can afford the repayment with your next paycheck, you could consider payday loans as the right option.

But remember that payday loans can be more expensive, and the APR can be as high as 400%, according to the Consumer Financial Protection Bureau.

if you handle payday loans irresponsibly, they can lead to a debt trap. Many consumers might not be able to repay the loan — and then get in a vicious cycle where they continue to take new loans in order to pay off debt. So you should only use this product as a last resort.

Pawn shop loans

A pawn shop loan is a secured, short-term loan you can get from a pawn shop. To borrow money from a pawnshop, you provide an item as collateral—such as jewelry, a TV or a musical instrument. A pawn shop will assess the value of the item and keep it on hand as collateral to back the loan.

If you default on your loan, the pawn shop can sell your item. Because a pawn loan doesn’t involve a credit check or application process, it could be perfect for consumers with few traditional lending options.

Title loans

Another option is a title loan. If you own a car, you can use your car’s title as leverage to access an emergency cash loan. This might seem like an easy and fast option since the process typically does not involve credit checks. But you risk losing your vehicle if you aren’t able to pay off the loan, so this option should be carefully considered.

Where can I get an emergency cash loan?

Multiple types of lenders offer emergency fast cash loans, including:

-

Traditional banks

- Online lenders

- Credit unions

- Credit card companies (cash advance)

- Relatives and friends

- Payday lenders

Remember, just because a borrowing option is available doesn’t mean it’s the best choice. Credit card cash advances, for instance, are very expensive and might hurt your credit history. Today, more and more consumers in need of fast cash prefer to apply online as it is easy, fast and hassle-free.

Steps to get an emergency loan

- Check your credit. Most creditors pay huge attention to applicants’ credit scores when making a lending decision, so check your credit history for any past-due accounts or mistakes, and fix them before requesting a loan. Once a year, you can view your report free of charge from all three credit bureaus at AnnualCreditReport.com.

- Find out what you can afford. Assess your monthly budget to understand whether you can afford to make payments each month. That way, when you’re comparing loan offers, you can select a payment plan that is most suitable for your budget.

- Pre-qualify and compare options. Even if you need cash urgently, you’d better spend extra time to find the best interest rate. Most creditors let you pre-qualify via the Internet to preview the loan’s interest rate, amount and repayment term. Pre-qualifying takes 3-5 minutes, and no matter how many times you do it, your credit score is never damaged.

- Gather documents and apply. Once you’ve found an affordable loan offer, collect the documents you need to apply for it. This usually includes proof of address, W-2s, pay stubs, and a state-issued ID. You could get a fast approval decision, but it might also take several hours or days.

Emergency loan rates & terms

The average APR varies from 5.99 to 24.99%. Most creditors charge no origination fee and act like intermediaries in the loan approval process by matching potential borrowers to direct lenders.

Since the online portal only plays the role of connecting borrowers and lenders, once you qualify for a loan and select a loan, it steps away and allows you to work with the lender directly.

The creditor has its own terms and rates, including the APR, which is individual for each customer. The available loan amount typically ranges from $500 to $5,000. Interest rates, as stated previously, can vary depending on the company, but that of payday loans can be quite high, ranging from 200% to 1300%.

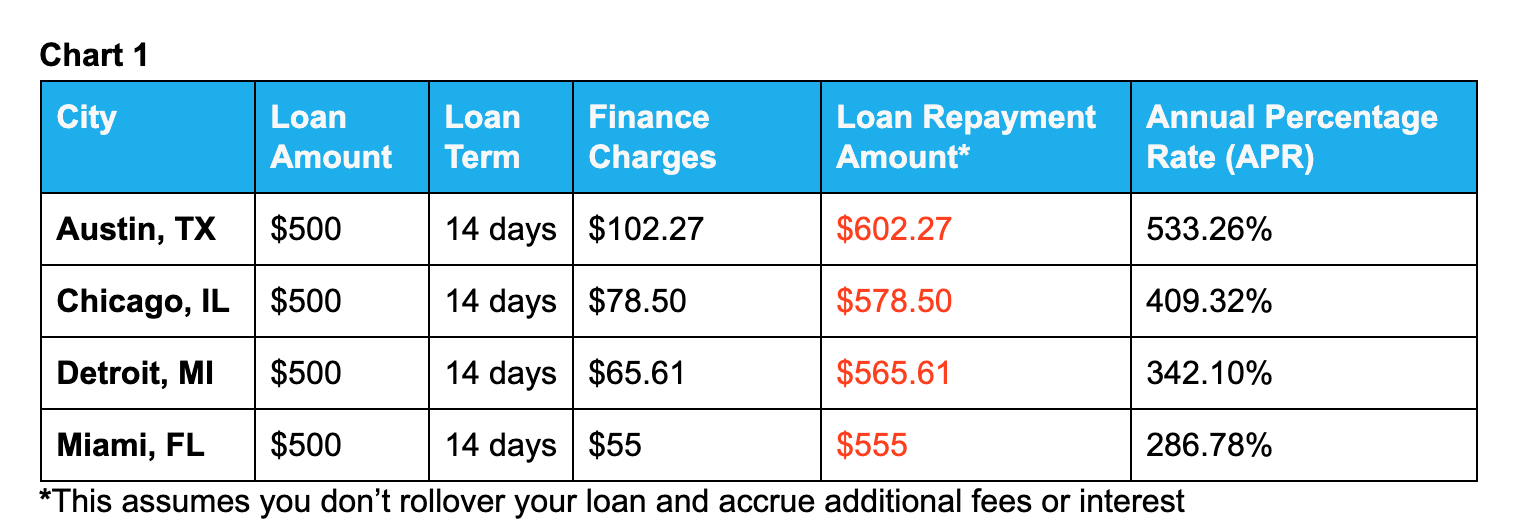

The chart below shows a few examples of emergency payday loan rates and terms in different states:

Can I take out emergency cash loans for bad credit?

Some bad credit loan providers may be willing to look at more than just your credit history when assessing your application. Although some of these creditors might still look at your credit, they may also pay attention to other factors, including your income and employment. Just stay informed that APRs can be high with these creditors.

Payday loans are the most demanded emergency cash loans for people with bad credit, as they usually don’t perform credit checks and the money might be available to you right away.

Will an emergency loan impact my credit score?

Some types of emergency loans can impact your credit score, while others will not. If a creditor doesn’t report your account to the credit bureaus, the loan won’t affect your credit score—unless you miss payments and a collection agency adds the bad debt to your credit reports at a later date. However, if a company does share your account information with the credit bureaus, that’s a different matter.

Banks, credit unions, and online lenders commonly report account details to the three major credit bureaus: Equifax, Experian, and TransUnion. Payday lenders and title lenders typically do not.

When a creditor reports an emergency cash loan to the credit bureaus, the way you handle your debt obligation determines whether it will help or damage your credit score. If you make timely payments, the account may improve your credit score over time. However, if you miss payments, that emergency loan could lower your credit score instead.

Borrower requirements for emergency cash loans

When applying for any type of loan, there will be certain borrower eligibility criteria to meet. Typically, you’ll have to meet the following criteria:

- Be a US citizen.

- be over 18 years of age.

- Have a valid checking account to receive money.

- Have a stable income of at least $800 per month.

- Be able to make payments in a timely manner.

As previously mentioned, there are also lenders that work with those with bad credit, helping them access emergency cash loans in 1 hour that are suited to them and their unique needs.

How fast can I get an emergency loan?

Multiple companies offer same day emergency cash loans today to qualified borrowers. Some lenders may even deposit the money into your bank account in an hour.

On the other hand, funding can sometimes take several days or even a few weeks. Certain creditors may take longer to process your request or release your money than others. It is also likely that your bank or credit union may hold the money a creditor deposits into your account for a few days before you can access the funds.

How to choose an emergency loan

- Affordability: Try to find the loan with the lowest APR as is the least expensive. You can also use APRs to compare emergency loans with other financing options such as credit cards.

-

Repayment: Weigh how the debt obligation will impact your budget to determine if you can comfortably make payments each month. Use an online loan calculator to see how the APR and repayment term affect the monthly payment.

- Fees: Keep in mind that some lenders may charge an origination fee. This can be 1% to 10% of the loan amount, and it’s generally subtracted from the loan before you get the money.

- Funding speed: If you need cash urgently, select a lender that offers same-day funding. Some creditors can issue the funds the next day, while others could take up to a week after approval.

- Other loan types: Many lenders offer unsecured emergency loans, but some also let you add a co-applicant or secure the loan to access lower rates or improve your chances of getting approved.

Why use us to find emergency cash loans online?

Our team evaluated multiple companies and collected the best emergency cash loans direct lenders in one place.

We took into account the flexibility of repayment terms, useful features like pre-qualification, and whether a co-signer or joint applications are allowed to ensure consumers get the best possible experience.

Our benefits include:

-

Flexibility – Our fast emergency cash loans are flexible and can be used for whatever purpose, whether you need the money to pay for a car repair, a medical bill or a rent payment. These types of loans can also have flexible repayment terms and may give you the option to repay your loan over a few weeks or make lower monthly payments over several months or years.

- Easy Application – Applying for an emergency loan is usually a fast and simple process. You can apply online or in-store depending on your needs and submit a request in just 5 minutes.

- Easy to Access. This borrowing option comes with relaxed eligiblity criteria. There are even emergency cash loans for unemployed, self-employed and retired people.

- Quick Approval Process – Once you apply for an emergency loan, you may get a decision right away. Many creditors have a fast approval process, so you won’t have to wait days or weeks to get the money you need.

- Convenience – Many creditors issue loans online and allow you to apply from the comfort of your home or office. An online application eliminates the need of going anywhere to get the money.

Tips to get an emergency loan with bad credit

A bad credit score (below 600 FICO) doesn’t typically prevent you from getting a loan, but your credit score is still considered.

Here are a few tips to get an emergency cash loan with bad credit.

✔ Add a co-signer or co-borrower. Adding a co-signer or co-borrower can boost your chances of getting accepted or getting a better rate. A co-borrower has equal access to the money, while a co-signer does not. If you have difficulty repaying your loan, the co-signer or co-borrower becomes responsible for the loan.

✔ Add collateral. Some creditors offer secured personal loans, which lets borrowers add collateral to the emergency cash loan and can help people with bad credit get money. If you default on your loan, the creditor can take the collateral.

✔ Add up income streams. Your monthly income is another relevant factor on your application. Most companies want to see that you earn enough to pay your regular expenses, afford the new loan payment and have a little leftover. Some creditors consider things like alimony, social benefits and even a partner’s wages as part of your income.

✔ Try a credit union. Many emergency cash loans without bank account issued by credit unions have low rates and minimum amounts of $500-$1,000. Some also issue payday alternative loans, which are small cash loans with APRs capped at 28%.

✔ Contact your bank. If you’re a client at Bank of America or U.S. Bank, you may qualify for one of their small-dollar loans. Bank of America’s Balance Assist offers to borrow up to $500 for a flat fee of $5. A Simple Loan from U.S. Bank can provide up to $1,000 with a fee of $6 for every $100 you borrow. Both are paid off in three monthly installments.

Emergency loan alternatives

Cheaper alternatives are not always speedy or convenient. But we strongly recommend considering alternatives first, even in an emergency. Here are some popular alternatives to emergency cash loans in one hour.

- Get help from local non-profit organizations, charity funds and religious organizations.

- Consider ways to pay off medical bills, like a payment plan or income-driven hardship plan.

- Apply for tax refund advance loans. These are short-term loans of $200 to $4,000 you take out when you’re already anticipating a refund from the IRS. Tax refund cash advance emergency loans 2022 are offered at no cost to you. The loan amount is deducted from tax refunds reducing the amount paid to you.

- Ask your employer for an emergency loan or paycheck advance.

- Consider using a loan app like Dave.

- Ask family or friends for a loan – this way you will avoid interest.

Get started today to get quick emergency cash loans now!

Secure Service

Secure Service

Bad Credit Friendly

Bad Credit Friendly

Quick Application

Quick Application

24/7 Client's Service

24/7 Client's Service

Traditional banks

Traditional banks

Repayment: Weigh how the debt obligation will impact your budget to determine if you can comfortably make payments each month. Use an online loan calculator to see how the APR and repayment term affect the monthly payment.

Repayment: Weigh how the debt obligation will impact your budget to determine if you can comfortably make payments each month. Use an online loan calculator to see how the APR and repayment term affect the monthly payment. Flexibility – Our fast emergency cash loans are flexible and can be used for whatever purpose, whether you need the money to pay for a car repair, a medical bill or a rent payment. These types of loans can also have flexible repayment terms and may give you the option to repay your loan over a few weeks or make lower monthly payments over several months or years.

Flexibility – Our fast emergency cash loans are flexible and can be used for whatever purpose, whether you need the money to pay for a car repair, a medical bill or a rent payment. These types of loans can also have flexible repayment terms and may give you the option to repay your loan over a few weeks or make lower monthly payments over several months or years.