Apply for Bad Credit Loans Guaranteed Approval – Get Started Today!

You can apply for bad credit loans online in a few clicks! There are several types of loans for those with poor credit, but the most popular unsecured loans, or loans that don’t require collateral. They can be a good option for borrowers with credit scores of 579 or less who need fast cash to cover unexpected costs.

If you are searching for guaranteed approval, we will help you borrow $100 to $5,000 and you can accepted in less than 5 minutes using our free online application form below.

Contents:

- What is a bad credit loan?

- What is considered bad credit?

- Types of bad credit loans

- Why is a credit score important?

- Secured vs. unsecured bad credit loans

- Who gives loans with bad credit?

- How to get personal loans with bad credit

- Who is eligible for bad credit loans?

- Bad credit loans in your state

- How to compare lenders

- How much does a bad credit loan cost?

- How fast can I get loans for bad credit?

- Types of installment loans for bad credit

- What are the best personal loans for poor credit?

- How to choose the best bad credit loan company

- How can I improve my credit in order to get a better loan?

- Repaying bad credit loans

- Reasons why your bad credit loan was declined

- How to boost your chances of getting approved for a loan with bad credit

- How to spot bad credit loan scams

- Advantages of loans for bad credit

- Disadvantages of loans for bad credit

- Bad credit loans: FAQs

- Bad credit loan alternatives to consider

What is a bad credit loan?

While no lender can guarantee a 100% loan approval to consumers with poor credits, those who get approved, usually, get much higher interest rates and less beneficial loan terms.

What is considered bad credit?

Credit scores range from 300 to 850, and though there is no official start to the “poor credit score” category, we can say if you’re under 650 you are considered a high risk, which means your loan will be more expensive. People in this category are the most common users of fast cash loans for bad credit.

The definition of a “good” and “poor” credit score varies by lender. Some won’t work with a credit score under 650; some are ready to approve consumers with a score less than 650.

So, it’s difficult to say what makes you “good” or “bad” candidate, but the generally accepted range looks like this:

- 760-850 – Excellent

- 700-759 – Very good

- 660-699 – Fair

- 620-659 – Poor

- Scores under 620 – Extremely poor

FICO Scores are used in over 90% of U.S. lending decisions. Here are the five FICO categories and how much each affects your credit score.

- Payment history: 35%.

- Amounts owed: 30%.

- Length of credit history: 15%.

- Credit mix: 10%.

- New credit: 10%.

Your payment history is the most important category, which tells lenders how often you’ve made on-time payments to other financial institutions. Missed credit card or loan payments can negatively affect your credit score and may cause the creditor to offer a higher interest rate or reject your loan application altogether.

Types of bad credit loans

Finding the right poor credit loan can not be easy, but there are a lot of options. The loan could be issued by your regular bank, but lower interest rates and relaxed borrower eligibility requirements probably can be found with these options:

- Credit Unions: A credit union loan comes with a maximum interest rate of 18%, which applies to any person, regardless of their credit score. A similar loan from a bank could come with a 36% interest. A credit union may be willing to ignore your low credit score and make a decision based on your character and your promise to pay off the debt. Veterans of the armed forces might be eligible for urgent loans for bad credit from the Navy Federal Credit Union. Teacher or government workers might get small personal loans for bad credit from the Schoolsfirst Credit Union.

- Get a Co-Signer: If you have a relative or friend with good credit ask them about co-signing for a poor credit loan. In this case, the lender will set the APR based on the credit score of the co-signer with good credit, who will then be equally responsible for repayment. But if you default on your loan or you miss payments, you both suffer. If you make payments responsibly, your credit score will increase, making it easier to get future loans.

- Home Equity Loan: If you have equity in your home, you can try to obtain a home equity loan or home equity line of credit (HELOC). Your home is used as collateral, and home equity loans can be obtained even with low credit. The interest rate is usually low because the loan is secured by the home. It is important to remember that you may lose your property if you default on your loan. But if you are responsible and have a stable income, it is an affordable way to borrow cash from a licensed lender.

- Peer-to-Peer Lending: Peer-to-peer lending (P2P lending) is an online platform that allows you to get a poor credit loan directly from another individual or group of individuals rather than from a financial institution. Potential borrowers post a loan listing on various peer-to-peer websites, indicating the desired amount and the reason they need a loan. Investors review the loan listings and choose borrowers they want to fund. Your credit score still matters, but these loans are often easier to get for people with poor credit. Eligibility criteria are significantly more relaxed and interest rates are usually lower than those offered by traditional lenders.

- Online Payday Loans: These lenders generally operate online and don’t have offices. They do their work via the Internet and offer $2000 loans for bad credit designed for various emergencies, such as debt consolidation, car repairs, home improvement, weddings, vacation, medical treatment, education costs, etc. Their key advantage is they work fast. Lenders can approve bad credit payday loans online in minutes and deposit the money in your bank account in a few hours or days. Many have no application fee or early repayment penalty. Online payday loan applications are simple and easy to fill out. Credit scores are of little importance so you may not worry if you have a low credit score or no credit. In fact, some payday loan lenders have their own credit-score model and don’t use FICO scores.

Why is a credit score important?

Having a good credit score means getting more options to consider when you need a loan. Lenders are willing to offer better borrowing terms and more competitive APR for borrowers with Good, Very Good, and Excellent credit scores. On the other hand, if you have a low credit score, it means that creditors think you have a high risk of delinquency.

According to the major credit bureaus, about 62% of people with credit scores below 579 are likely to default on their loans. This is why it is difficult to get an affordable loan when your credit score is less-than-perfect.

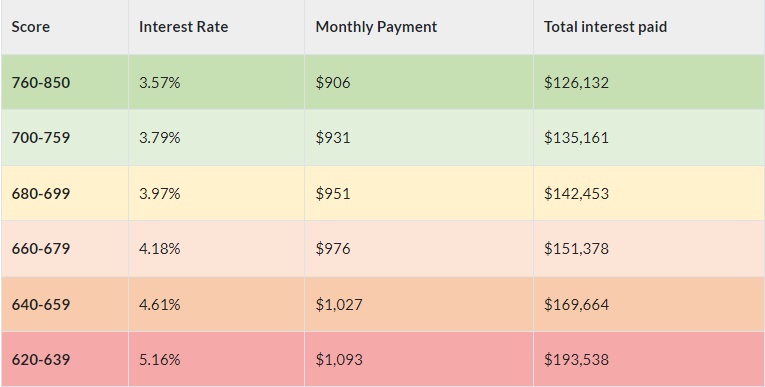

How Your Credit Score Affects a 30-year, $200,000 Home Loan:

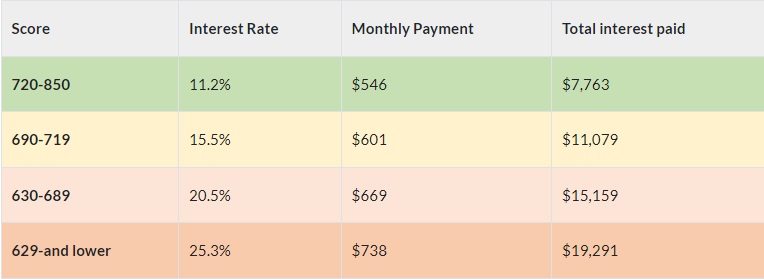

How Your Credit Score Affects a 5-year, $25,000 Auto Loan:

Secured vs. unsecured bad credit loans

If your credit score is suffering, the best chance to borrow cash could be through a secured loan, which involves collateral (apartment, vehicle, boat, property, savings or even stocks). The creditor will hold the asset as collateral against you defaulting on the loan. If you don’t pay off the loan, you lose the asset. Secured loans for bad credit come with higher loan amounts, lower interest rates and beneficial terms than unsecured loans.

An unsecured loan has nothing more than a promise that you will pay off your loan on time and it could be not easy to get an unsecured loan from most banks. Banks tend to issue unsecured loans to their best customers – people who have a steady income and good credit history – and are very cautious about lending funds otherwise.

An unsecured loan is no risk for the borrower, but high risk for the creditor so you can expect much higher interest rates and little flexibility on qualifying or terms of the loans.

Who gives loans with bad credit?

Where to get loans with bad credit? You can typically apply:

- Online: Some online lenders offer easy loans for bad credit loans. These creditors often consider information beyond your credit and income to approve your request, though those are still relevant factors in a loan decision.

- At a credit union: Credit unions assess traditional information like your credit score and income but may also consider your standing as a credit union member. A member who has a good relationship with the credit union may get approved for a personal loan despite a poor credit score.

- At a bank: Banks also make loan decisions based primarily on your credit score, history and income. Major banks are less flexible on borrower eligibility requirements, but having a good relationship with a local bank may help you get accepted.

How to get personal loans with bad credit and low income

The application process is 100% safe, secure, and hassle-free. When you apply for extremely bad credit loans online, it takes just a few minutes to fill in the application form and another 1-3 minutes to get a decision. You can apply for bad credit personal loans guaranteed approval $5 000 on this website.

The overall application can be easily completed in 4 steps:

- Check eligibility criteria;

- Prepare the required documents;

- Fill out an online application;

- Review the offer and e-sign an agreement upon approval.

Who is eligible for bad credit loans?

Before applying for a loan with a poor credit score, make sure that you meet these requirements:

- You are of legal age in your state;

- You have a source of a steady income source;

- You have a valid photo ID, such as a driving license;

- You have a valid email address and phone number;

- You have an active bank account.

Bad credit loans in your state

Poor credit loans are available in the following states:

- Alabama;

- Alaska;

- California;

- Delaware;

- Florida;

- Hawaii;

- Idaho;

- Illinois;

- Indiana;

- Iowa;

- Kansas;

- Kentucky;

- Louisiana;

- Michigan;

- Minnesota;

- Mississippi;

- Missouri;

- Nebraska;

- Nevada;

- North Dakota;

- Ohio;

- Oklahoma;

- Rhode Island;

- South Carolina;

- Tennessee;

- Texas;

- Utah;

- Virginia;

- Washington;

- Wisconsin;

- Wyoming.

How to compare lenders

Searching for a poor credit loan can be a tiresome process, the first thing everyone wants to know is: What’s it going to cost?

When comparing lenders, be prepared to evaluate much more than cost before e-signing a loan agreement.

Here are a few things that you need to assess.

- Am I eligible? The eligibility requirements may include a minimum credit score requirement; the necessary debt-to-income ratio and the borrower’s minimum income size.

- Interest rates. Compare interest rates offered by various lenders, then decide what’s best for you.

- What are the repayment terms? Some poor credit loans may be issued for 3-5 years, but many lenders still limit the terms to a few months or even weeks. Ask before you sign.

- Am I comfortable with the lender? You can get a poor credit loan in various places. You need to know if face-to-face communication with a bank or credit union employee matters more to you than the speed and limited communication you have with an online creditor. If something unforseen happens during the lending term, this could become an issue.

How much does a bad credit loan cost?

The APR for a poor credit loan varies from lender to lender. Below are the estimated APR by FICO score range:

| CATEGORY | CREDIT SCORE | PERCENTAGE OF PEOPLE IN THIS CATEGORY | ESTIMATED APR |

| Excellent | 800-850 | 21% | 10.3%-12.5% |

| Very good | 740-799 | 25% | 10.3%-12.5% |

| Good | 670-739 | 21% | 13.5%-15.5% |

| Fair | 580-669 | 17% | 17.8%-19.9% |

| Very poor | 300-579 | 16% | 28.5%-32% |

How fast can I get loans for bad credit?

The speed of financing depends on the financial institution. For example, online lenders are usually the quickest option, sometimes offering instant approval decisions. On the other hand, it could take longer to get the funds if you contact traditional banks and credit unions.

Below are the funding times you can expect in most cases:

- Online lenders: Less than 5 days.

- Banks: 1 to 7 business days.

- Credit unions: 1 to 7 business days.

There are also some lenders that provide same day loans for bad credit. For example, several our partner lenders transfer the funds to the borrower’s bank account instantly.

If you want to get quick loans for bad credit, here are a couple of ways to avoid delays:

- Fill out the application form as accurately as possible.

- Provide any required documentation on time.

Types of guaranteed installment loans for bad credit

Personal loans are usually what consumers think of when they hear “installment loans”. But there are actually some other types of installment loans, some of which are also available for borrowers with low credit scores.

- Home equity loan. You can get a loan against your home’s equity for up to 30 years. The loan is secured by your apartment, so you risk losing it if you can’t repay it. Also, keep in mind that home equity loans usually have a credit score requirement of at least 680. But if you have a lot of equity, you are likely to get one with poor credit.

- Auto loan. An auto loan is a loan that you can use to purchase a car or other vehicle, and it usually lasts for 2-3 years. If you can’t repay the loan, your vehicle can be repossessed. There are auto lenders that accept consumers who have poor credit, but they usually charge expensive rates.

- Student loan. Student loans help you pay for education and living expenses while you are in college, and they generally last up to 10 years. How to get student loans with bad credit? Apply for federal student loans – they typically don’t involve a credit check, so you can be eligible with poor credit. Student loans for bad credit don’t require collateral, either.

- Credit-builder loan. If you have a poor credit score, a credit-builder loan can help you improve it. It works like the reverse of a traditional loan. You make monthly installment payments to a creditor with a bank transfer or check, and then get that funds in a bank account at the end. The creditor will report to the credit bureaus on a monthly basis, which will fix your credit score.

What are the best personal loans for poor credit?

There are several types of personal online loans that consider people with low credit scores, each loan option has its pros and cons. Keep in mind that there is no guarantee that you will get approved for any of these legit loans if you have a terrible credit score.

Here is a comparison table that will help you better understand which bad credit loan is most suitable for your unique needs:

| Payday Loans | Installment loans | Title Loans |

| Short-term. Up to 2 weeks. | Long-term. 2 to 24 months. | Long-term. 1 to 24 months. |

| No collateral required. | No collateral required. | Car title is used as collateral. |

| Repaid in a lump sum. | Repaid in monthly installments. | Repaid monthly. |

| Bad credit is ok. | Bad credit is ok. | Bad credit isok. |

| Maximum loan amount is $1,500. | Maximum loan amount is $10,000. | Maximum loan amount is $25,000. |

| Average APR is 450%. | Average APR is 300%. | Average APR is 35%. |

How to choose the best bad credit loan company

There’s no single best loan for bad credit for everyone. The best bad credit loan company for your individual needs depends on several factors:

- Eligibility requirements. Many companies will show eligibility requirements on their websites, including the minimum credit score, the minimum income size, and the maximum debt-to-income ratio.

- Interest rates and fees. Creditors use various criteria to calculate your interest rate. Obtain quotes from several creditors and compare interest rates and other fees/penalties to determine which will have the most beneficial interest for you.

- Repayment terms. Lenders may offer repayment terms of anywhere from 12 months to 12 years. A shorter repayment term means that you’ll repay the debt sooner and will overpay less overall. A longer repayment term, on the other hand, will reduce your monthly payment.

- Type of lender. Personal loans are offered by credit unions, banks and online lenders. Online lenders often promise speedy funding. However, a local credit union that you already work with may be more willing to extend you a loan based on your good relationship.

How can I improve my credit in order to get a better loan?

There are several tips that could be used to improve your credit score so you can more easily obtain future loans and be eligible for better rates. Some of these are as follows:

-

Make timely payments on all of your bills: Your payment history is one of the most relevant factors that make up your credit score. If you pay all of your bills in a timely manner, your credit score will increase over time.

- Pay down credit card balances: Your credit utilization ratio is how much you currently owe divided by your credit limit. It is generally expressed as a percent. It’s also another relevant factor in your credit score. If you can pay down balances on credit card accounts, your score could improve.

- Do not take new loans if possible: Obtaining new loans can temporarily lower your credit score while also adding to your overall debt loan. Try to avoid taking new loans while working to fix your credit.

Repaying bad credit loans

The purpose of a poor credit loan is to repay debts while improving your credit score at the same time. You succeed when you create a budget that will allow you to make timely payments every month.

And if something unforeseen happens, like the loss of a job or disease, inform your lending institution. They usually meet borrowers halfway and help them out in situations like this.

Don’t get into a debt trap by not making payments.

Reasons why your bad credit loan was declined

Why might your loan request be denied? There are only a few common reasons.

- You have a poor credit history: you have existing delinquency on another loan.

- You have an excessive debt load. You might have so many loans that lenders cannot give you a new one.

- You have recently become bankrupt.

Did you answer “No” to all three items? Then it is possible that information from a third party got into your credit history, there is an error in your credit report that prevents creditors from correctly evaluating you as a borrower. Yes, it happens. Request your credit report, find out what is wrong with it, fix it and you will regain the ability to take loans from banks or other financial institutions.

What can you do if you’re denied a personal loan?

If you’re denied a personal loan with bad credit, you can do the following.

- Look for borrowing alternatives. If a traditional bank has denied you, an online lender or credit union may be willing to give you a loan. If you can be eligible for a credit card. Look for a credit card with low promotional rates.

- Build your credit. Your score can increase over time if you make at least the minimum payment every month. Close all your current debts so that your credit history improves. You should also check your credit reports for mistakes since any error or inaccuracy on your credit report could hurt your score.

If you’re denied a loan because of information in your credit report, you should receive an adverse action notice from the creditor, giving you an explanation. This can help you find out why you were denied a loan.

How to boost your chances of getting approved for a loan with bad credit

- Try to improve your credit. If you do not need cash urgently, you might want to postpone your request for a few months until you have increased the credit range up to 640 – 699. You will then have more options, with more beneficial terms.

- Avoid expensive lenders. Payday lenders and car title lenders work with low credit and advertise speedy funding, but you should use them only as a last resort. Beware: they may charge too high fees and interest rates.

- Consider credit unions. Credit unions often agree to work with consumers who have poor credit. They have relatively low APRs and tend to charge $0 origination fees. You can search for credit unions in your area online.

- Get pre-qualified. You can use free online pre-qualification tools to check your eligibility and potential rates with multiple lenders before applying. This will help you avoid applying with a creditor that’s likely to decline your request.

How to spot bad credit loan scams

While seeking a personal loan, look out for scammers that might want to take advantage of you. Below are the signs you’ve come across a scammer:

-

Guarantees without approval: Credible lenders typically want to see your credit report, income and other information before making an offer. If you deal with a creditor that isn’t interested in your payment history, this might be a “red flag”.

- No registration in your state: The Federal Trade Commission requires that creditors be registered in the state where they issue loans. Find out whether the lender is licensed in your state.

- Poor advertising methods: Phone calls and door-to-door solicitation are not legitimate advertising practices for reputable lenders. Also, avoid loan offers that pressure you into accepting them immediately.

- Prepayment: If a company requires you to provide money or a prepaid debit card upfront, it’s a bad sign.

- Unsecured website: A creditor’s website should be secure, meaning the website address should begin with “https” and have a padlock symbol on any page where you enter sensitive personal information.

- No physical address: A trustworthy lender should have a physical address specified on its website.

Advantages of loans for bad credit

✔Such loans are speedy: Most poor credit loan applications can be completed online and it only takes a few hours or even minutes to get a response. In some cases, you can have the funds in your bank account the same day you apply.

✔Lower interest rate than credit cards: If you are able to get a poor credit loan, it likely would come at a lower interest rate than you pay on credit card debt.

✔Multiple options: The number of bad credit loan providers grows every year. If you search properly, you might find a cheap loan.

✔Repayment term length: Depending on who the creditor is, repayment periods could vary anywhere from 1 to 5 years.

✔Fix your credit: If you make payments in a timely manner, your credit score will increase and make you a more attractive candidate next time you apply for a loan.

Disadvantages of loans for bad credit

❌High interest rates: You’re a risky borrower, so the lender wants a reward.

❌Fees and penalties: Always read the fine print. Make sure the lender charges no origination fee, no late fee, no prepayment penalty, etc. Check carefully – some companies charge a fee for making payments by check.

❌Collateral sometimes required: You may have to provide collateral (a house or a car) to get approved for the loan. If you default on your loan, you could lose your house or car.

❌Might not be licensed: Not every lender is licensed in every state. Be sure the creditor you work with is certified in your state before you sign an agreement.

❌Can increase debt: It’s important to assess your budget correctly and ensure you can afford monthly payments. Greedy lenders are all too happy to take your funds. If you have any doubts, call a nonprofit credit counseling agency and talk about options.

❌Assess multiple offers: The competition gives you a chance to compare and select the best company for your individual needs.

Bad credit loans: FAQs

How much can I borrow with a bad credit loan?The amount you can borrow varies according to your state’s laws, your lender and your finances. Most creditors are able to lend somewhere from $300 to $1,000. Check your state’s payday lending policies. This doesn’t mean you’ll be accepted for the maximum amount allowed by law. A payday lender may consider your income size when deciding how much you can borrow.Can I get bad credit loans guaranteed approval?No. There is no way you can get a guaranteed approval loan, no matter how good your credit is and what kind of loan you are applying for. There is no such thing as “guaranteed bad credit loans”. Offering a 100% guarantee on loan approvals is a common practice used by dishonest creditors and brokers which we recommend avoiding.What is the easiest type of loan to get with bad credit?The easiest types of loans to get with poor credit are no-credit-check loans, including title, payday and pawnshop loans.

What happens if I can’t pay off a loan?

If you default on your loan, you’ll be charged penalties and fees which will make your loan very expensive. Your credit scores will also go down.

Is there risk in fast loans for bad credit?

Whenever you get a low credit loan, you take on some risk. While most personal loans are unsecured, you still risk hurting your credit score if you miss your monthly payments. To avoid the risks, always use the loans responsibly and watch for your credit history, existing debts, and income sources.

Can I get a loan with no credit checks?

Yes. We can match you with direct lenders who perform soft credit checks only, even if you have a poor credit history. A typical soft credit check will not affect your credit score, while hard credit checks can damage your credit history.

Bad credit loan alternatives to consider

- Use an interest-free cash advance app. Mobile apps like Earnin and Brigit can offer interest-free or low-fee cash advances on your paycheck up to several days ahead of time, though there are borrower eligibility criteria and caps on how much money you can borrow.

- Ask if your bank offers a small-dollar loan. Some US banks offer small-dollar loans that can help you deal with emergency expenses. For example, Bank of America’s Balance Assist provides short-term loans for existing clients with a good reputation.

- Borrow money from a family member or friend. Your friend or relative may be able to lend you the money. This will save you cash on interest, and there will not be any credit checks involved. Just make sure you will be able to repay the debt on time.

- Reach out to a community organization. There are organizations that provide free funds to cover essential expenses. Search online for local community organizations to see what’s available in your state.

You could also think about a credit card cash advance or a pawnshop loan. These options should come with lower interest rates than a payday loan, but they are still expensive.

Once your cash emergency passes, start creating a financial cushion. It is great if you can save even a few hundred dollars over time – they will help you out when emergencies arise.

Secure Service

Secure Service

Bad Credit Friendly

Bad Credit Friendly

Quick Application

Quick Application

24/7 Client's Service

24/7 Client's Service

Make timely payments on all of your bills: Your payment history is one of the most relevant factors that make up your credit score. If you pay all of your bills in a timely manner, your credit score will increase over time.

Make timely payments on all of your bills: Your payment history is one of the most relevant factors that make up your credit score. If you pay all of your bills in a timely manner, your credit score will increase over time. Guarantees without approval: Credible lenders typically want to see your credit report, income and other information before making an offer. If you deal with a creditor that isn’t interested in your payment history, this might be a “red flag”.

Guarantees without approval: Credible lenders typically want to see your credit report, income and other information before making an offer. If you deal with a creditor that isn’t interested in your payment history, this might be a “red flag”.