Motive Loan

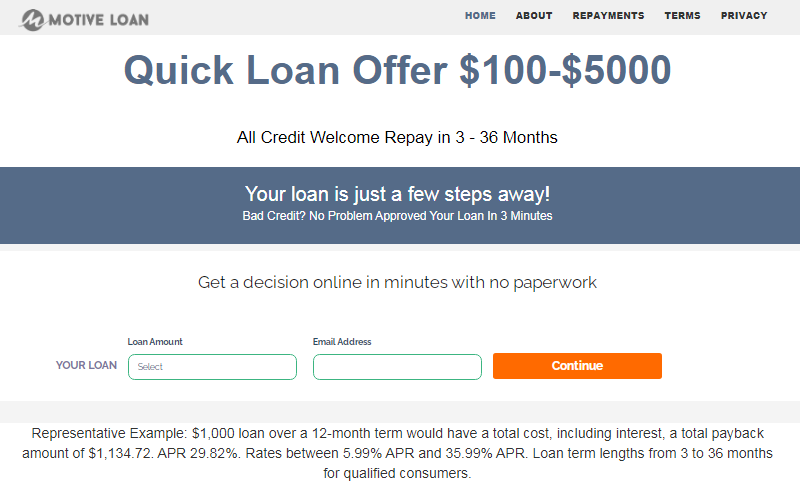

Online Payday Personal Consumer Loans up to $5,000

Easy Application, Fast Processing, Quick Approval, Any Credit Score

Request a LoanMotive Loan is a referral service that works by connecting consumers to licensed lenders across the USA that are willing to provide personal loans online up to $5,000 quickly, easily and securely. The company cooperates with an extensive network of reputable lenders so that consumers have more options available to them and can select the best offers for their needs and budget.

| Company name | Motive Loan |

| Founded | Unknown |

| Address | 2885 Sanford Ave SW #42543 Grandville, MI 49418, United States |

| Website | motiveloan.com |

| Phone number | No |

| [email protected] |

Pros

Pros

- Offers from a range of lenders

- Easy and fast online application

- Personal loans up to $5,000

- Potentially fust funding

- Pay once to twice a month

- 72 months to repay your loan

- Bad credit is ok

- None pre-payment penalty

Cons

- Not a direct lender

- No customer service phone number

- Not available in New York

Bottom Line

Overall, Motive Loan is a nice way to find the best loan quickly. If your credit is fair or poor, finding a payday loan can be difficult, but this service has made it much easier. This website is recommended for those who have bad credit or even bankruptcy. Note that residents of New York are not eligible to use the service to request a loan.

Types of loans

Motive Loan offers personal loans ranging from $100 to $5,000. However, they mention that not all lenders in their network can provide up to $5,000.

Personal loans are typically used for debt consolidation, home remodeling, moving costs, emergency expenses, appliance purchases, vehicle financing, wedding expenses, medical treatment, etc.

Loan requirements

To get approved for a personal loan with Motive Loan, you must typically comply with the following requirements.

- Legally live/reside in one of the U.S. states (except New York);

- Be at least 18 years of age;

- Have a valid bank account in your name;

- Be employed and have proof of income.

Even though our lenders may need to perform credit check to verify your credibility, in most cases they may not consider your credit history as the major factor to approve your request for funding.

Category: Online Loans

Tags: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

Posted by Shane Barton

Pros

Pros