MoneyLion

Online Payday Personal Consumer Loans up to $5,000

Easy Application, Fast Processing, Quick Approval, Any Credit Score

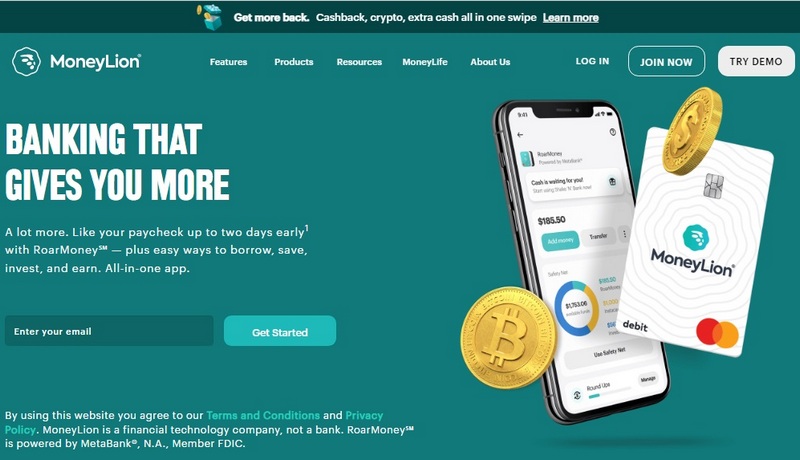

Request a LoanMoneyLion is a finance app that offers a range of financial products and services. It offers a membership program that includes online banking services, cash back rewards, interest-free cash advances, managed investing, credit-builder loans, financial tracking and education, and more. The company was founded in 2013. It is headquartered in New York City and has more over 6 million users. MoneyLion has achieved various awards of recognition.

| Company name | MoneyLion Inc. |

| Founded | 2013 |

| Address | 30 West 21st Street Ninth Floor New York, NY 10010 USA |

| Website | moneylion.com |

| Phone number |

1-888-704-6970

|

| [email protected] |

Pros

- Fast online applicaion

- No hidden fees

- Quick funding

- Loans up to $1,000 with competitive rates

- Credit monitoring and tracking 24/7 in the app

- All credit scores accepted

- Help build your credit score

- Access to 0% APR Instacash cash advances

- Exclusive cashback rewards

- LiveChat function

- No hard credit check

- Easy repayment

- Early repayment option

Cons

- Not available nationally

- Too many bad reviews

- Hefty monthly fee required

- You may only qualify to borrow less upfront

- Your monthly payments could be “trapped” for a year

Bottom line

MoneyLion credit builder loans are best for consumers who can’t get a loan in other financial institutions due to bad or zero credit. Since the company reports all credit payments to the three major nationwide credit bureaus, its loan products can help you build or improve your credit history. Their loan products come with low APRs, however, its monthly membership charge can be quite high, depending on your loan amount. It seems to us that it makes no sense to borrow small amounts from this lender and pay its $19.99 monthly fee.

Types of loans

MoneyLion loan options are very limited. They only offer credit-builder loans (up to $1,000) that could help you fix or build your credit with on-time payments.

Eligibility criteria

To get approved for a MoneyLion loan, you must:

- be 18 or older;

- have U.S. citizenship or permanent residency;

- have a Social Security number;

- have a checking account in good standing that has been open for at least 60 days.

Category: Online Loans

Tags: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Washington, Wisconsin, Wyoming

Posted by MiaAshton