LendingClub

Online Payday Personal Consumer Loans up to $5,000

Easy Application, Fast Processing, Quick Approval, Any Credit Score

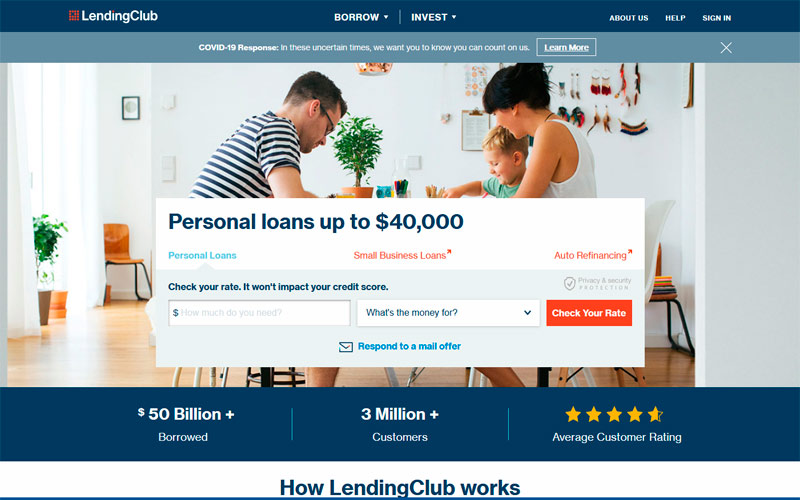

Request a LoanLending Club is one of the most popular peer-to-peer lenders in the industry. They offer loans ranging from $1,000 to $40,000 with APR ranging from 6.95% to 35.89% The lender promises quick access to funds, flexible loan terms, and competitive rates that beat what most banks will offer you. Repayment terms are either 36 or 60 months.

| Company name | LendingClub |

| Founded | 2006 |

| Address | 71 Stevenson Street, Suite 300, San Francisco, California 94105 |

| Website | lendingclub.com |

| Phone number | (415) 632-5600 |

| [email protected] |

Pros

- Borrow up to $40,000

- Quick, easy online application

- Soft credit check with pre-qualification

- Fixed interest rates

- No prepayment fees

- Joint loan option

- Auto refinancing

- Support individual investors

- Patient solutions

- Flexible usage options

Cons

- High APRs

- Doesn’t offer a mobile app to manage your loan

- Origination fee

- Takes time to get money

- Bad deal for poor credit

- Few options for loan terms

- Personal loans not available nationwide

Bottom line

LendingClub is a good option for you if you have a good credit score and don’t need immediate access funds. Also, co-borrowers are allowed, which is not offered by every lender.

Taking out a personal loan with this company might be a good idea if you need access to extra money to make a large purchase or to consolidate your debt. Surf the net and compare various loan offers to find the lender that offers the best rates and terms.

Types of loans

Lending Club is offers personal loans, lines of credit, business loans, auto refinancing, and patient solutions, which helps cover the cost of expensive drugs and dental procedures.

This lender wants to know how you’ll be using the borrowed money. The options are:

- Credit card refinancing;

- Debt consolidation;

- Home buying;

- Car financing;

- Home improvement;

- Major purchase;

- Green loan;

- Moving and relocation;

- Medical expenses;

- Business;

- Vacation.

Loan requirements

To get approved with Lending Club, you need to:

- be at least 18 years old;

- be a US citizen or legal resident;

- have a verifiable bank account;

- have a minimum credit score of 600;

- have a minimum credit history of three years;

- have the debt-to-income ratio less than 40% for single applications and 35% for joint applicants.

Right now, the lender only accepts applications from 49 of the 50 United States. Residents of Iowa and U.S. territories are not eligible.

Category: Online Loans

Tags: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

Posted by Deborah Wagner