Fortuna Credit

Online Payday Personal Consumer Loans up to $5,000

Easy Application, Fast Processing, Quick Approval, Any Credit Score

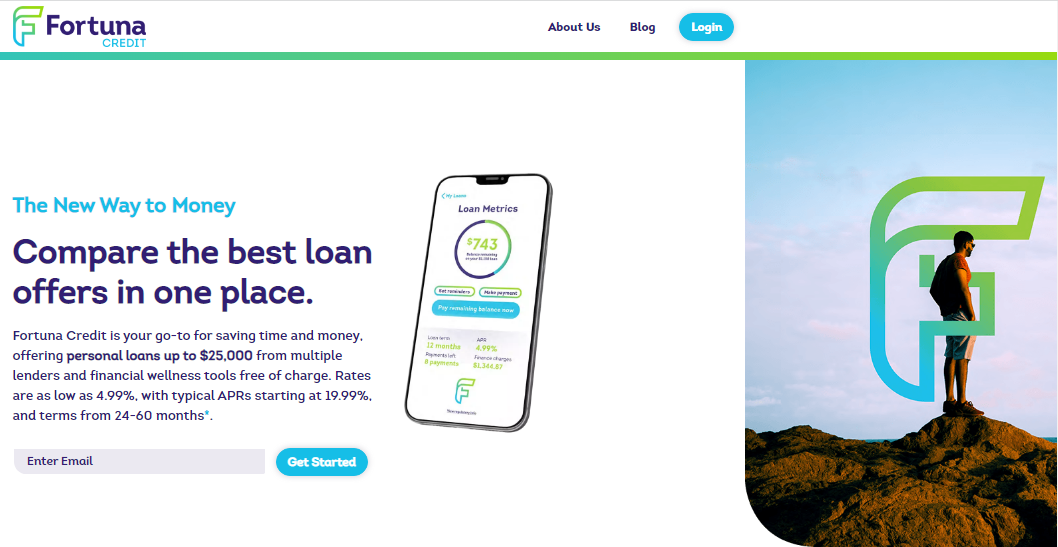

Request a LoanFortuna Credit is an online-only multi-lender marketplace that works by matching consumers to financial products tailored to their unique needs in all 50 states. They provide access to personal loans up to $25,000 for 24-60 months from multiple lenders. Rates are as low as 4.99%, with typical APRs starting at 19.99%. Fortuna Credit was founded by data nerds in 2020. The company works with customers having less-than-perfect credit. Fortuna Credits also provides free financial wellness tools, such as budget tracking, overdraft protection, and credit monitoring to help people save money and reach their financial goals.

| Company name | Fortuna Credit |

| Founded | 2020 |

| Address | 135 N Church St Spartanburg, South Carolina 29306, US |

| Website | fortunacredit.com |

| Phone number |

No

|

| [email protected] |

Pros

- Available nationwide

- Loans up to $25,000

- Pre-approval possible

- Fast and easy online application

- Apply online around the clock

- Quick approval

- No credit checks involved

- Free financial management tools

Cons

- Not a lender

- Not BBB accredited

- Limited user reviews

Bottom line

You can use Fortuna Credit to compare offers from 25 different lenders. The process is easy and quick. However, we recommend that you explore other places that have more experience and better user reviews.

Types of loans

You can use Fortuna Credit website to apply for personal loans and title loans from over 25 direct lenders. You can access up to $25,000 from the comfort of your home with a hassle-free, easy application.

- A personal loan is an unsecured loan (no collateral required). You can use it for any purpose: home improvement, car repair, business expenses, vacation, debt consolidation, credit card debt refinancing, wedding expenses, etc. You repay your loan in equal monthly payments over a definite period of time, typically with no penalty for repaying the loan early.

- A line of credit is a flexible loan from that consists of a defined amount of money that you can access as needed and repay either immediately or over time. With a line of credit, you can borrow money up to a preset maximum amount, which you then repay with the APR applied, by a specific date. Interest is charged on a line of credit as soon as money is borrowed.

Eligibility criteria

To get a loan with Fortuna Credit, you must meet the following requirements:

- You must be at least 18 years of age.

- You must have a job (or another permanent source of income).

- You must have an active checking account in your name.

- You must be a US resident.

Credit requirements vary by lender, but Fortuna Credit can help you compare options from multiple lenders regardless of your credit score.

Category: Online Loans

Tags: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

Posted by MiaAshton