Credible

Online Payday Personal Consumer Loans up to $5,000

Easy Application, Fast Processing, Quick Approval, Any Credit Score

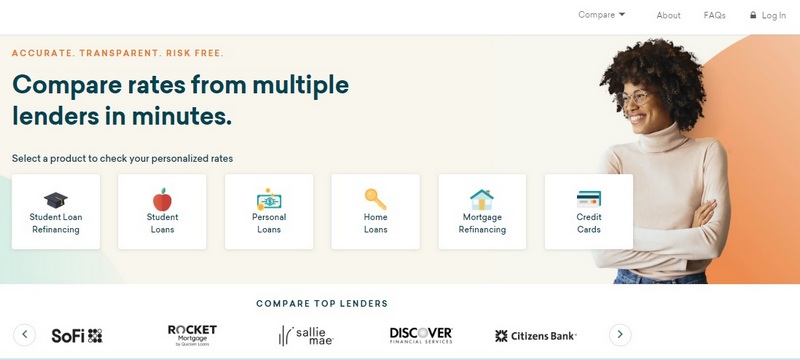

Request a LoanCredible is a marketplace that allows consumers to compare multiple offers from different US lenders for student loans, mortgages, personal loans, student loan refinancing, and credit cards. The lenders from the Credible’s network are some of the biggest names in the industry. This is a free service, and comparing loan offers doesn’t impact your credit score. The company is based in San Francisco, California, and was founded in November, 2012. The Better Business Bureau (BBB) gives the company a rating of “A+”!

| Company name | Credible Operations, Inc. |

| Founded | 2012 |

| Address | 22 4th St Fl 8 Fl 8 San Francisco, CA 94103-3131 |

| Website | www.credible.com |

| Phone number |

(866) 540-6005

|

| [email protected] |

Pros

- Free to use

- Risk-free comparison

- Secure website

- Simple online application

- Real people, here to help

- Terms from 5 to 20 years

- Co-signed loans available

- $300 to $5,000 loans

- Doesn’t affect credit

- BBB-accredited

- Multiple repayment options

- Comprehensive FAQ section

Cons

- Not a direct lender

- Not available in all states

- Not all lenders are included

- Not all terms and conditions are listed

- May miss out on loan benefits

Bottom line

Credible is a nice option for consumers who want to compare multiple refinancing options and choose the best one. The service is free to use and won’t affect your credit score, but choosing a loan through this online platform could cause you to miss out on federal benefits.

Types of loans

Credible products include:

- Refinance student loans

- Private student loans

- Personal loans

- Home loans

- Mortgage refinancing

- Credit cards

Loan requirements

To get approved for a loan via Credible, you must:

- Be 18 years old or older;

- Be a U.S. citizen or permanent resident;

- Be employed and have a steady income.

If you have bad or fair credit, you can still get approved for a loan, however, you are likely to pay higher rates in this case.

Category: Online Loans

Tags: Alabama, Alaska, Arizona, Arkansas, California, Delaware, Florida, Georgia, Idaho, Illinois, Indiana, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, Wyoming

Posted by Deborah Wagner