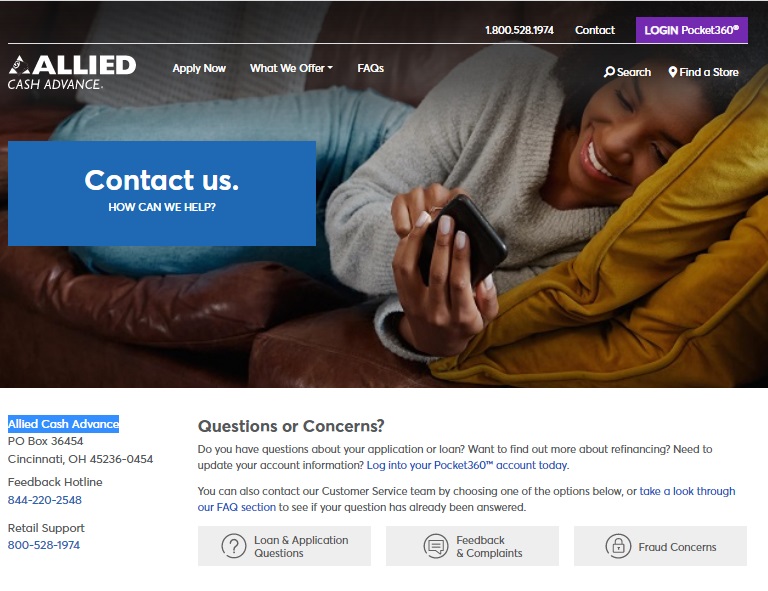

Allied Cash Advance

Online Payday Personal Consumer Loans up to $5,000

Easy Application, Fast Processing, Quick Approval, Any Credit Score

Request a LoanAllied Cash Advance is a both a lender and a referral service that offers short-term financial solutions to people in 18 states. Depending on your state, you may be able to borrow from $50 to $5,000. The company focuses on people with bad credit and offers both in-store and online loans. In-store financial services are available at 70+ locations.

| Company name | Allied Cash Advance |

| Founded | 1999 |

| Address | P.O. Box 36454, Cincinnati, OH 45236-045 |

| Website | alliedcash.com |

| Phone number |

844-220-2548

|

| No |

Pros

- Direct lender

- Quick funding

- Less-than-perfect-credit

- Multiple loan options

- Member of the CFSA and OLA

- Easy repayment options

- Loans up to $5,000

- Borrower contact options

- Refer-a-friend bonus

- No credit check

- Experienced company

- Rapid approval

- Available both online and in stores

Cons

- Limited availability

- Not BBB accredited

- Too many user complaints

- Online loans through Check ’n Go

- No APR information

- Virginia lawsuit

Bottom line

Allied Cash Advance is a legit company that offers payday loans, lines of credit and installment loans directly and through its reputable partner lender, Check ‘N Go. With three different options available, the lender may be able to help get you get fast cash for your emergency needs. But its not transparent about rates, fees and terms. Moreover, Allied Cash Advance has had some legal issues in the past and user reviews aren’t great. Before you apply with this company, compare your other short-term loan options.

Types of loans

Allied Cash Advance offers three loan products:

- Payday loans (or cash advance loans);

- Short-term installment loans;

- Lines of credit (only available in-store in Virginia).

Payday loan amounts range somewhere between $100 and $865. Loan fees range from $25 to $134.07. Payday loans are short-term and are typically repaid in two to four weeks.

Installment loans may go up to $5,000 and usually have terms lasting a few months.

The lender offers in-store services in five states, which are:

- Arizona

- California

- Virginia

- Indiana

- Michigan

Additionally, you can apply for funding online in the following states:

- Alabama

- Florida

- California

- Hawaii

- Illinois

- Indiana

- Kansas

- Maine

- Michigan

- North Dakota

- Mississippi

- Missouri

- Nevada

- Ohio

- Oklahoma

- Texas

- Wyoming

- Utah

- Delaware

- Idaho

- New Mexico

- South Carolina

Eligibility criteria

To qualify for a loan with Allied Cash Advance, you have to meet the following criteria:

- Valid bank account;

- Steady source of income;

- Government-issued ID;

- US citizen or permanent resident;

- Age of majority in your state.

Category: Online Loans

Tags: Alabama, California, Florida, Hawaii, Illinois, Indiana, Kansas, Maine, Michigan, Mississippi, Missouri, Nevada, North Dakota, Ohio, Oklahoma, Texas, Utah, Wyoming

Posted by MiaAshton